Marginal tax calculator

This is 0 of your total income of 0. 0 would also be your average tax rate.

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

. If you are using Internet. 0 would also be your average tax rate. Javascript is required for this calculator.

Your income puts you in the 10 tax bracket. This is 0 of your total income of 0. 0 would also be your average tax rate.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. Your income puts you in the 10 tax bracket.

2020 Marginal Tax Rates Calculator. This is 0 of your total income of 0. Standard or itemized deduction.

Your Federal taxes are estimated at 0. Your income puts you in the 10 tax bracket. Your income puts you in the 10 tax bracket.

Your income puts you in the 10 tax. Your income puts you in the 10 tax bracket. Discover Helpful Information And Resources On Taxes From AARP.

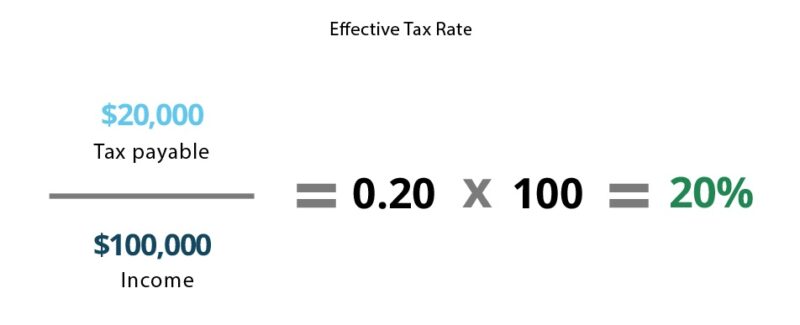

Personal tax calculator. When you divide the tax payable with the taxable income of 63000. This is 0 of your total income of 0.

0 would also be your average tax rate. 0 would also be your average tax rate. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

2021 Marginal Tax Rates Calculator. Your Federal taxes are estimated at 0. Calculate the tax savings.

At higher incomes many deductions and many credits are phased. At higher incomes many. At higher incomes many deductions and many credits are phased.

Your income puts you in the 10 tax bracket. Your income puts you in the 10 tax bracket. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

This is 0 of your total income of 0. 0 would also be your average tax rate. Your Federal taxes are estimated at 0.

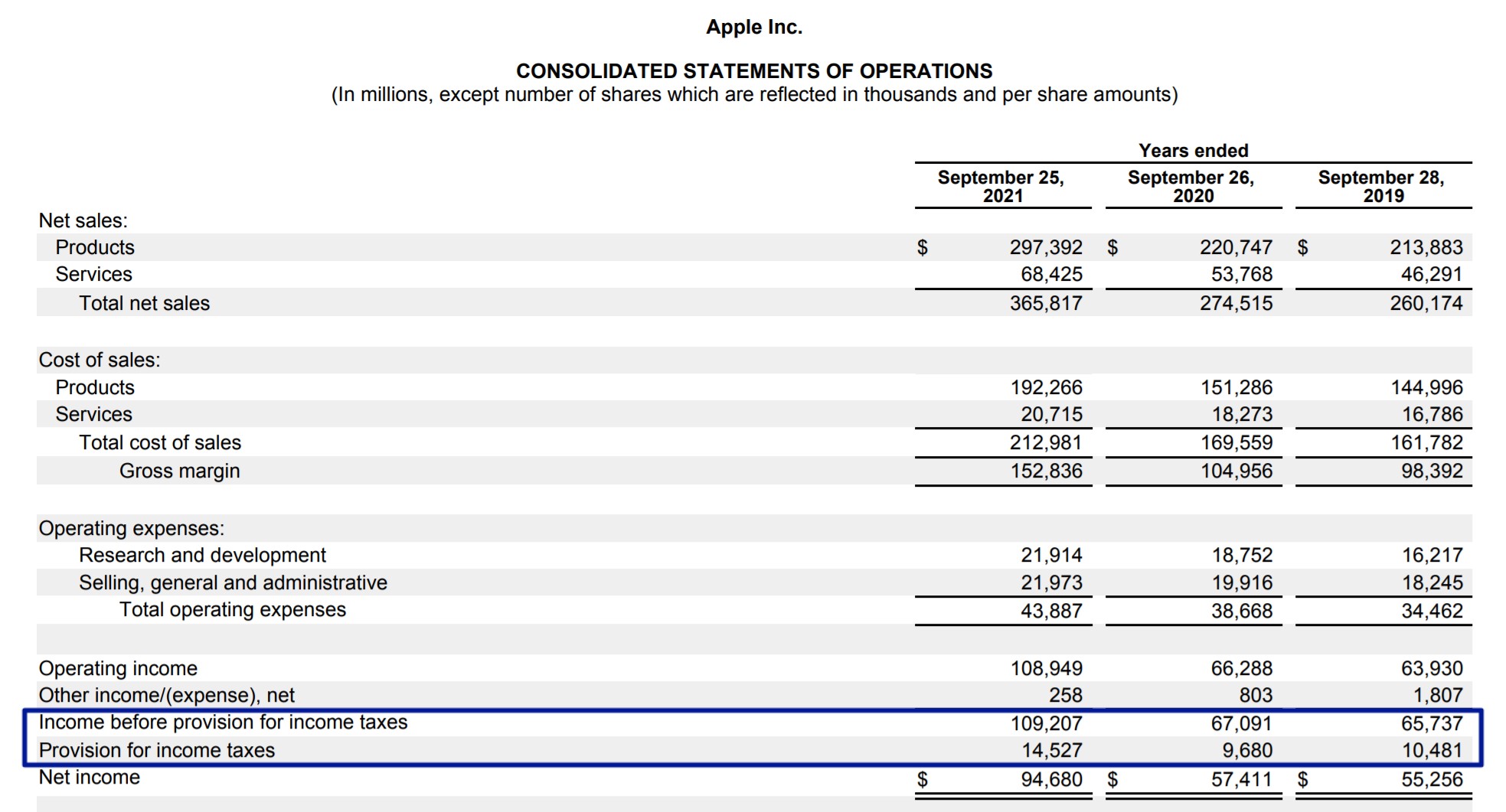

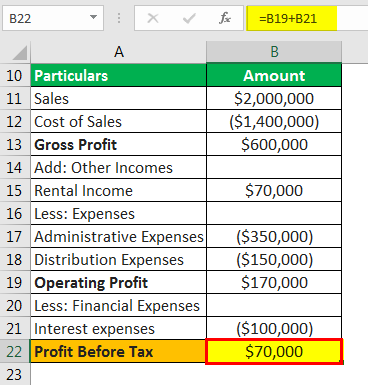

Calculate your combined federal and provincial tax bill in each province and territory. From the practical example above the total tax due was 9574. Marginal Tax Rate vs.

At higher incomes many. This is 0 of your total income of 0. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

This is 0 of your total income of 0. This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased.

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. 0 would also be your average tax rate. At higher incomes many deductions and many credits are phased.

This is 0 of your total income of 0. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. At higher incomes many deductions and many credits are phased.

Marginal Tax Rate Calculator. 0 would also be your average tax rate. Your income puts you in the 10 tax bracket.

0 would also be your average tax rate. 0 would also be your average tax rate. At higher incomes many.

Your income puts you in the 10 tax bracket. Your Federal taxes are estimated at 0.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Effective Tax Rate Formula And Calculation Example

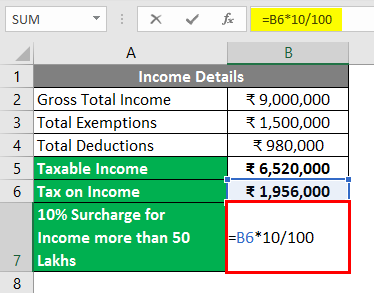

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How Is Taxable Income Calculated How To Calculate Tax Liability

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

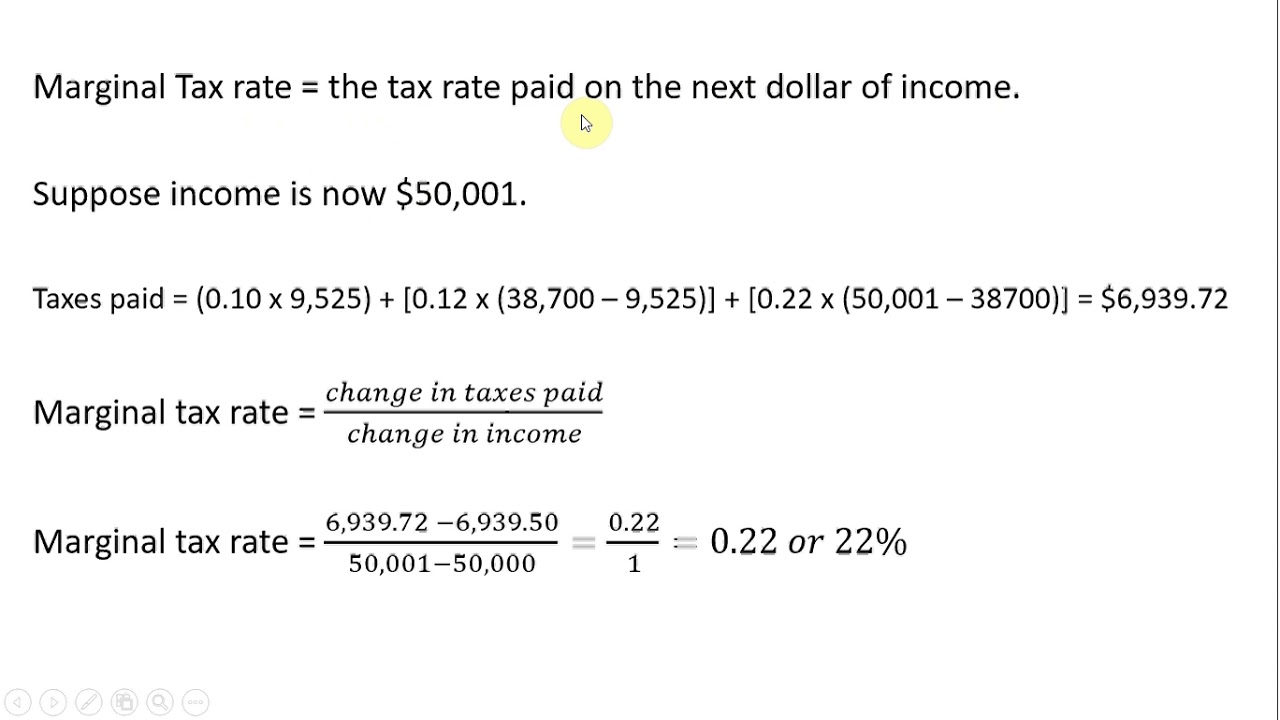

Marginal Tax Rate Formula Definition Investinganswers

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Provision For Income Tax Definition Formula Calculation Examples

Marginal Tax Rate Bogleheads